- Disciplined financial practices are crucial to extending the life of a company’s early funding and lengthening its runway.

- We recommend that pre-series A startups begin with some combination of three basic accounts, along with a business credit card, to help manage and track the use of liquid capital.

- Understanding the differences between account options allows startups to make the best choices about the deployment of financial resources.

Build a solid financial foundation for your business

You’ve launched a business and successfully raised capital from seed investors, friends and family and others. You have the money to develop your business and pursue your passion. The question now is, “How to manage and grow those funds while you are growing your business?”

Managing your early funding with discipline ensures your company has the longest runway possible and develops a track record of success, positioning it to maximize valuation for Series A. But where do you start?

Step one is understanding what kinds of accounts are available, and how each can be used to help you operate your business — pay for expenses, earn interest on your excess funds, collect payments and extend your financial reach through prudent use of credit. When employed together, the right accounts can help you ensure your funds are safely held, carefully monitored and positioned for growth.

You also need to understand what to consider when evaluating potential banking partners, including the products they offer and what services they can provide to you. Selecting the right partner can save money and make tracking your finances easy — so you can focus your attention on running your business.

Getting started: Four essential tools to manage day-to-day cash flow

Managing a startup’s finances typically involves three types of bank accounts: business checking accounts (also known as demand deposit accounts), money market accounts and cash sweep accounts, along with a business credit card. Each can play an important role in helping startups grow.

- Business checking: Provides startups with an account for making payments and receiving revenue. With a business checking account, you can start paying employees, settling bills and receiving any revenue your company is earning, as well as tracking your finances and tax obligations. This account is a good home for working capital and using it over time will help you build your business credit rating.

- Money market: Pays interest on funds held in the account, so holding excess capital in a money market account can extend your runway. With this approach, you’ll need to transfer funds to your checking account periodically to ensure it has sufficient funds to cover operating expenses.

- Automated cash sweep: Offers a comparable rate of interest to an MMA and automates the movement of funds to and from your checking account. Funds are swept back and forth overnight to keep sufficient money in checking while allowing you to earn interest on the cash sweep balances.

- Credit card: Offers another way to make payments and manage cash flow as well as extending your company’s runway via the judicious use of credit. Credit cards make it easier to track business expenses and pay bills. And any rewards points offered on purchases can be used to offset business expenses.

Choosing the right partner

Selecting the right banking partner is as important as setting up the right kinds of accounts. You want to work with a bank you can trust, does not charge excessive fees and provides services that will help your startup thrive.

As you’re vetting banks, ask:

- Do they have experience working with founders?

- How are the bank’s products designed to meet startups’ needs?

- How do its fee structure and the yield on its accounts compare to the other partners you’re considering?

- Will accessing its services and using its technology make your startup’s financial life easier or more difficult?

- How could banking with them benefit your business?

Startup banking with SVB

With more than 40 years of experience in the technology, life sciences and healthcare sectors, we offer business banking accounts that meet founders’ needs and position startups to help meet milestones and grow their valuation.

For early-stage startups, we offer key financial products that are designed to meet the needs of your founder journey at each stage. They are:

- SVB Edge1 : Optimized for startups, SVB Edge is designed to help jump-start pre-Series A companies. Checking is free for the first three years, saving your company money during those crucial early years. The account charges no maintenance or transaction fees and includes access to all four of the following products.

- Startup MMA2: A great first step in managing your excess cash. Easy to establish and fully liquid, this MMA is backed by the strength of SVB and First Citizens Bank, which has the liquidity to cover uninsured deposits by 155% as of the third quarter of 2024.

- Cash sweeps: Choose from a variety of SVB automated sweep offerings to meet your cash investment needs. Our Insured Cash Sweep3 product provides multi-million dollar enhanced FDIC coverage on sweep balances. Or select our Cash Sweep4 product, which automatically moves balances into AAA-rated money market funds managed by third-party advisors.

- SVB Innovator Card5: Offers 2x unlimited points, no annual fee and no foreign transaction fees. This scalable business card gives you more flexibility to manage purchases and payables, helping drive growth with higher credit limits, no personal liability and robust spending controls.

- Merchant Services6: Accept payments on your website or app. SVB Merchant Services make it easy to start accepting a variety of payment types, get paid quickly and manage it all in an intuitive dashboard.

No matter which accounts you choose, our award-winning digital banking platform makes cash management easy. We provide connections to QuickBooks, Xero, Expensify and other authorized applications to make account keeping easier.

Final thoughts

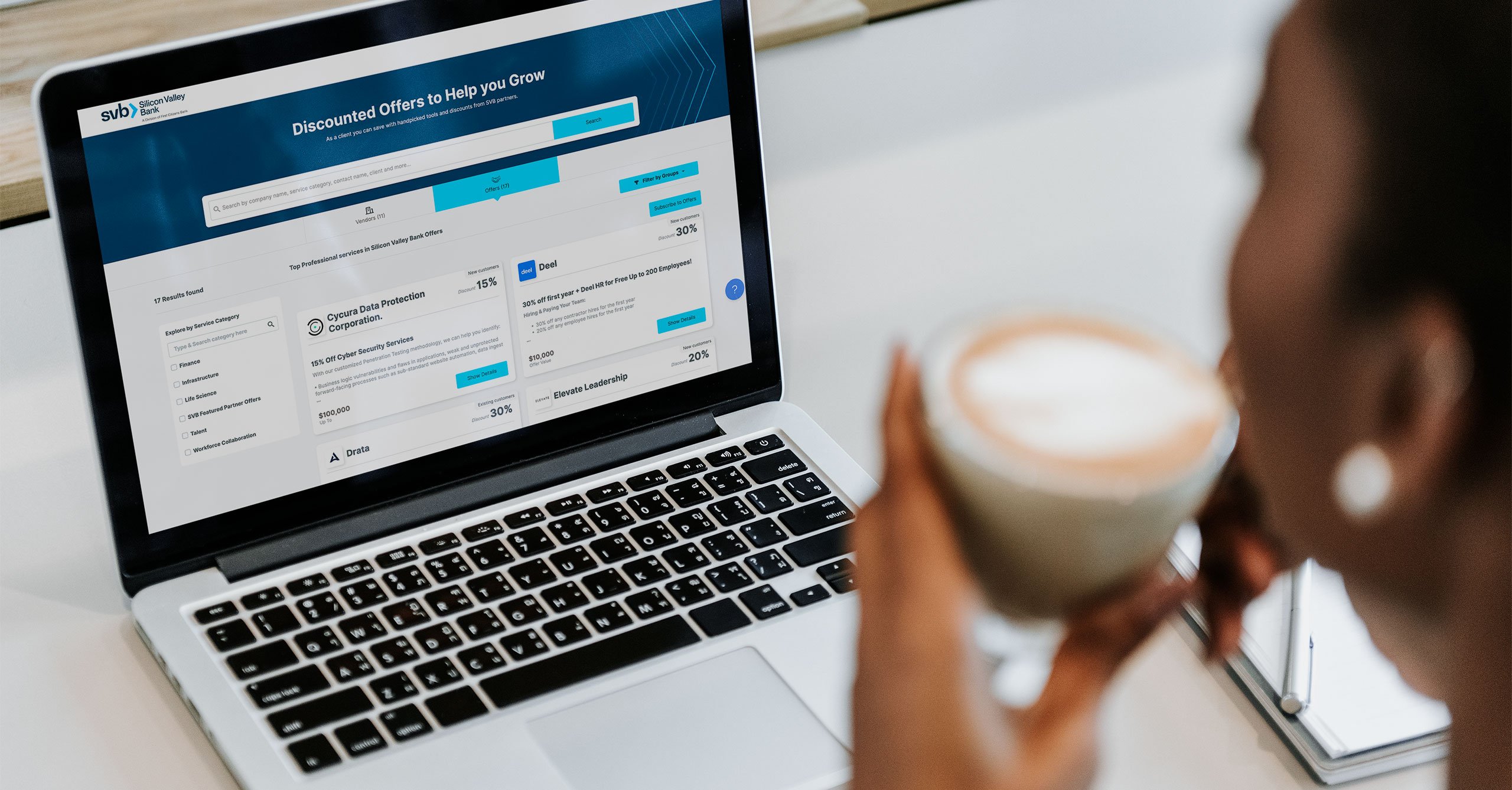

In addition to our banking products, SVB can provide connections and referrals to crucial business services such as accounting organizations, temporary CEO firms, human resource providers and others. And thanks to our long history in the innovation ecosystem, SVB customers are eligible for exclusive offers from our partners.

At SVB, we’re dedicated to supporting your company as it grows, with banking solutions and support that scale along with your business.