- Tariffs are taxes placed on imports to balance trade between trading partners.

- The threat of tariffs has had a measurable impact on inflation expectations.

- Although the present situation is dynamic, we believe there is limited appetite for lasting tariffs given that we are still recovering from a period of sticky and elevated inflation.

Economic vista: Tariffs - it's different this time

Jon Schwartz, Portfolio Manager

Tariffs–those taxes or duties levied against various import items–are all over the news these days. The on-again, off-again status of tariffs is fueling volatility in financial markets as investors try to sort through the news and anticipate the ultimate ramifications that tariffs might have on inflation, interest rates, and the overall economy.

The case for tariffs is they are a tool to balance trade terms between trading partners. If you look at the United States’ largest trading partners, China, Canada and Mexico make up approximately 40% of the goods imported to the country. More importantly, however, the US makes up a much larger portion of these three countries’ exports. It is estimated that 78% of Canada’s exports and 80% of Mexico’s exports ultimately arrive on US soil, based on 2023 data. Such a lopsided trade imbalance gives the US substantial leverage when it comes to tariffs and negotiating trade deals. This was a significant factor during the tit-for-tat trade war that took place throughout most of Trump’s first term. Tariffs and the retaliatory responses took many forms, particularly with China, including levies to aluminum, steel, solar panels, aircraft, automobiles, soybeans, chemicals and other imports, as well as outright bans on commerce with Chinese companies like Huawei. China continues to have the largest trade surplus with the US, as we buy far more Chinese goods than we sell into Chinese markets.

Digging a little deeper, we can see that in theory, tariffs have many possible uses. For example, instituting tariffs on China might help offset Chinese government subsidies that are creating a competitive advantage over US firms. President Trump ran on a platform that promised to ignite a manufacturing renaissance in the US and raising the prices of imported goods might encourage onshoring of manufacturing. Sometimes, tariffs can be used as leverage to drive other outcomes as well. Tariffs against our neighboring trading partners, Mexico and Canada, may be used to tighten borders, address immigration and even help slow the flow of fentanyl and other illegal drugs to the US.

Uncertainties abound

Although financial markets often react immediately to the latest news, we must come to terms with the fact that we may not learn important details regarding tariffs—the duration, the size of levies, the goods that might be excluded—for some time. Behind the scenes negotiations are always ongoing. And the reality is that the situation is inherently fluid. Such uncertainty not only roils markets, but it can cause real economic friction, which can lead to stalling or reducing business investments and even eroding consumer confidence.

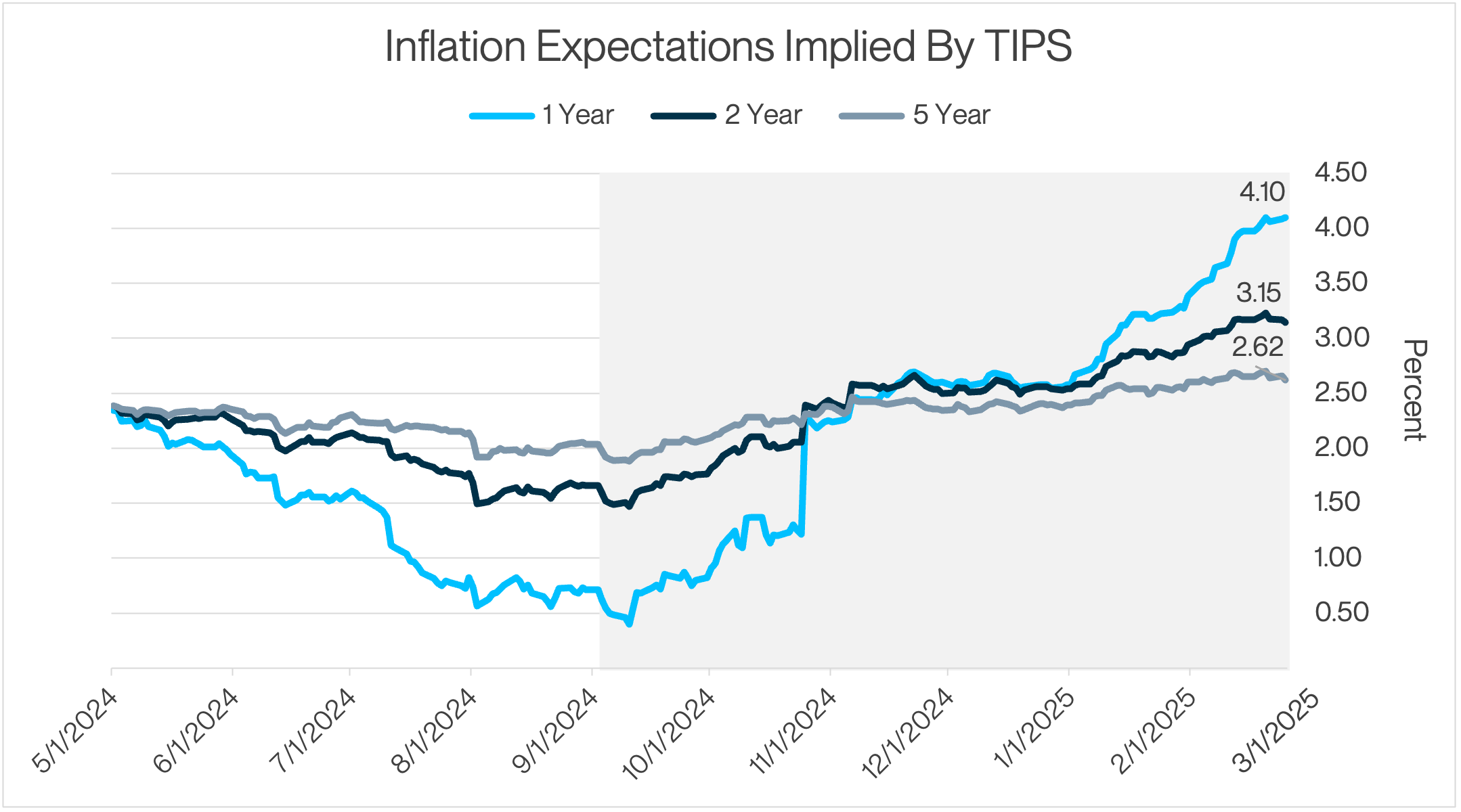

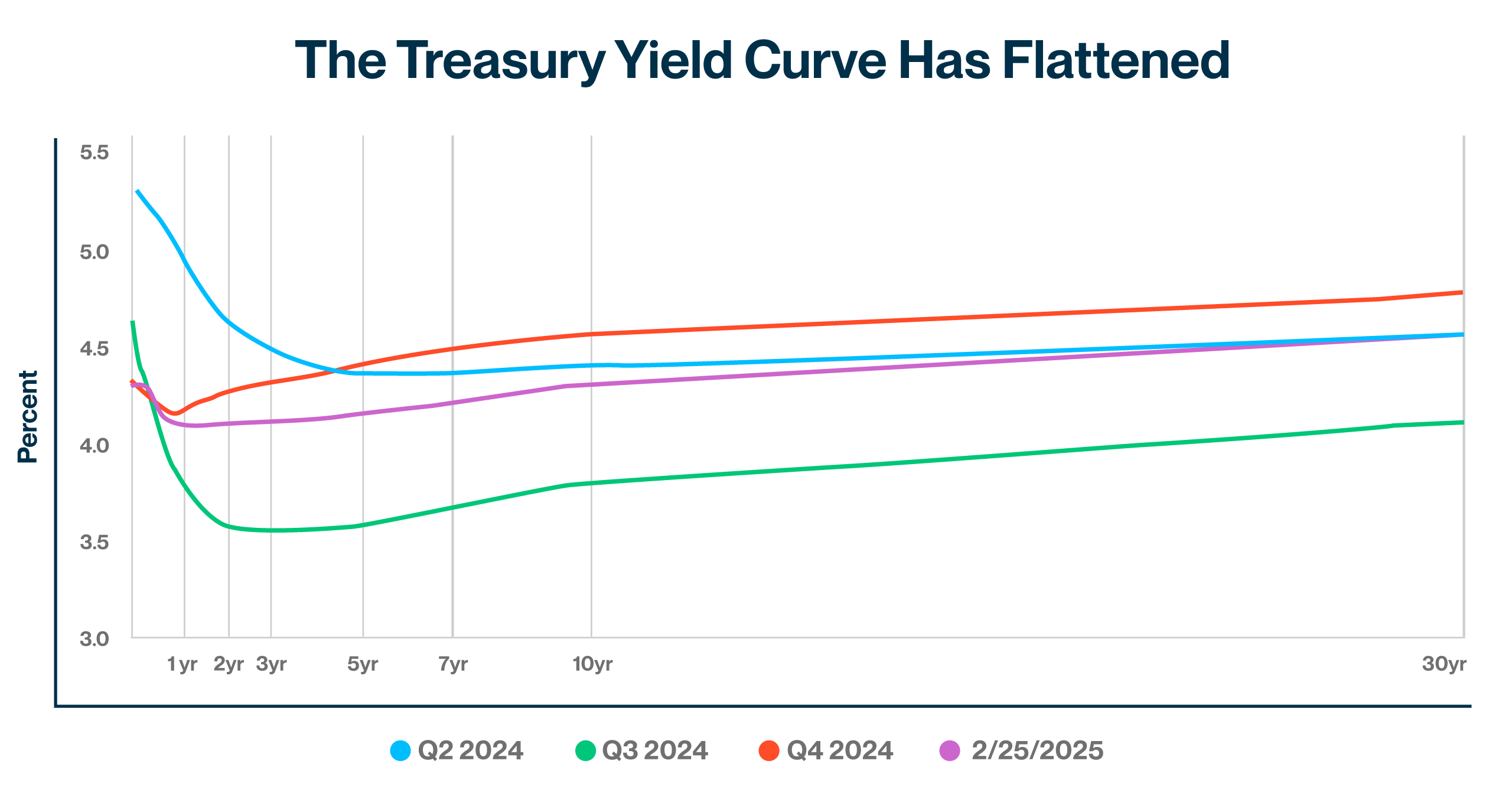

Perhaps even more than economic uncertainty, many investors are focused on the fact that increased prices due to tariffs could have a very real impact on inflation and inflation expectations. The uptick in inflation expectations can be seen when we study Treasury Inflation Protection Securities (TIPS). TIPS are basically US Treasuries with the yield adjusted by what inflation is expected to average over the investment horizon. For example, looking at 1-year TIPS, we can see the US Treasury rate is 4.18%, while the 1-year TIPS are trading at 0.08%. This implies that CPI is expected to average 4.10% over the next 12 months. But remember, there are other variables at play, such as supply constraints for TIPS and other factors. Still, the trend in expectations for higher inflation in the near- and longer term is quite clear when looking at 1-, 2- and 5- year TIPS.

Source: Bloomberg, data as of 02/25/2025.

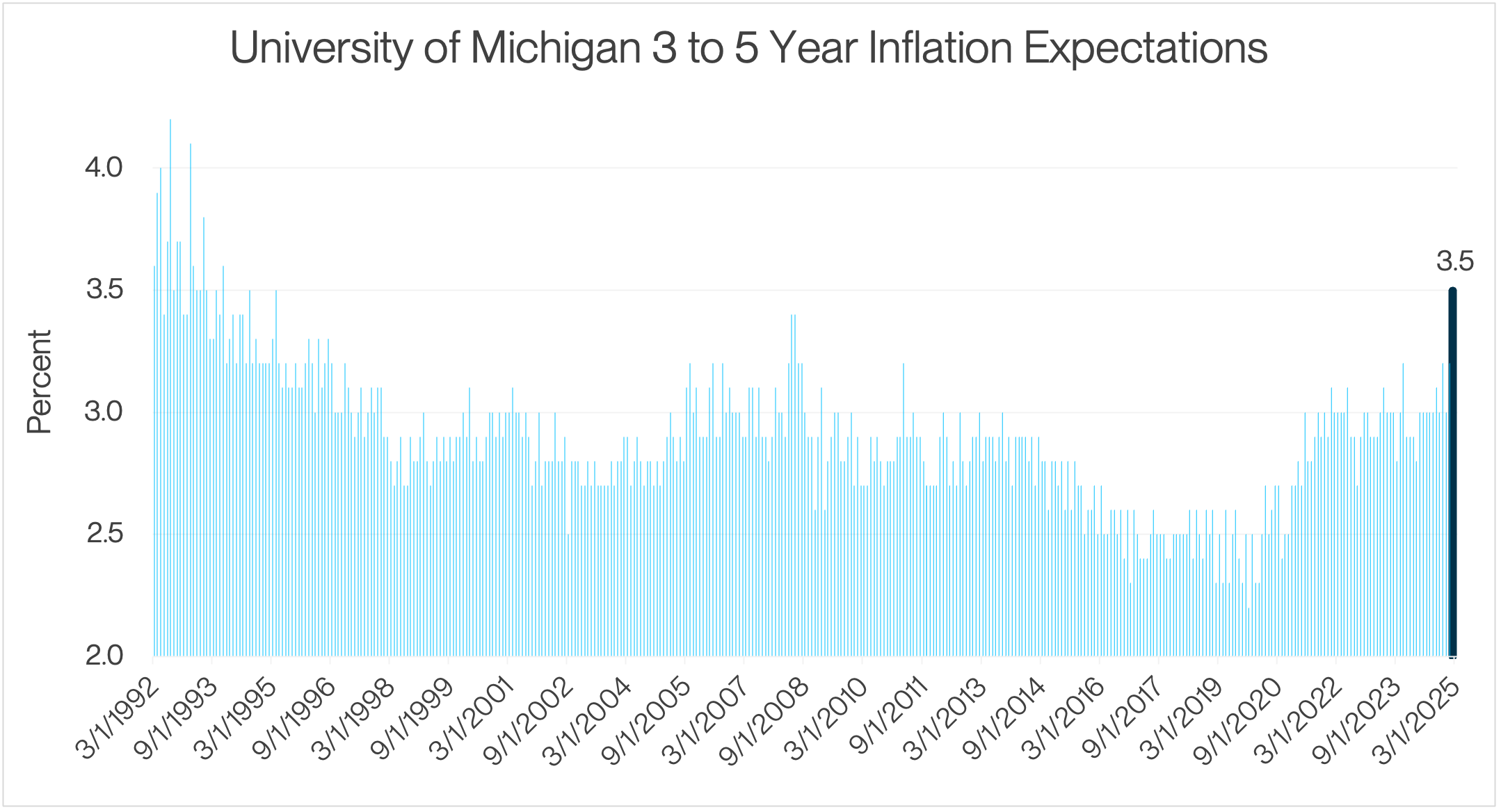

Along with these market-implied yields that reflect higher inflation expectations, we can also look to survey data that tells a similar story. The University of Michigan conducts a consumer sentiment survey monthly. One component of this survey asks participants to share their expectations for inflation over the next three-to-five years. The February survey result was quite an anomaly with three-to-five-year inflation expectations coming in at 3.50%. This was by far the highest reading in recent history. You would have to go back to the mid-1990s to see inflation expectations higher than they are today!

Source: Bloomberg, data as of 02/28/2025.

Keeping Calm

Bear in mind these are just a few data points, but it’s quite informative to observe both market-driven data where investors are deploying capital, as well as survey data for the expected path of inflation. But in our view, the real question is: How motivated is the new administration to enact tariffs that may result in higher inflation? After all, inflation that took place under the prior administration was a big talking point leading up to the election. Will President Trump and his team really carry through with policies that may push prices higher on the consumer? We’re not entirely convinced.

Of course, we believe it is rational to expect any introduction of tariffs to be gradual and used as transactional leverage towards specific outcomes with our trading partners. Nonetheless, the market is always quick to handicap the expected economic impact of any proposed economic policies. Remember, the last time the Trump administration enacted tariffs, we were in a very different inflation regime and CPI was comfortably below 2%. Since the pandemic, however, inflation has been troublesome, and the Fed has been fighting to slow rising prices.

These unknowns have driven the Fed to shift from its easing policy stance to more neutral, and the FOMC is taking a “wait-and-see” approach on changing policies and the forthcoming economic reaction. In December the Fed revised its forecast for inflation higher, and suggested there will be only two rate cuts in 2025 (down from four). Policy uncertainty has led to a recalibration of expectations with respect to inflation, and the Fed. This all supports the “wait and see” approach.

So, what’s the takeaway? Of course, nobody has a crystal ball regarding tariffs. And while there are many factors in play today that remind us of 2017 to 2021, we think that the recent memory of post-pandemic inflation is fresh in the minds of investors—and voters. As a result, we think that the ultimate appetite for punitive and lasting tariffs is quite different this time around. Pro-growth and pro US policies may stoke animal spirits in the long term, and there’s bound to be a few bumps along the way.

Credit vista: The long-term trend for ratings is looking up

Edward Lee, CFA, Credit Analyst

Do BBB-rated investment grade (IG) corporate bonds still make the grade for liquidity portfolios? That was the assertion in our prior article and nothing in the current environment has changed our view materially.

Today’s follow-up reiterates the belief that attractive compensation can still be earned by taking on just a tad more credit risk, which we believe is manageable with the aid of some thorough fundamental research and analysis.

Understand the Ratings

One can safely assert that issuers across the IG spectrum are generally large, stable, and highly profitable companies. Accordingly, IG rating outcomes are often more constrained by capital structure and financial policy decisions than by revenue and operating cash flow generation ability. While there are indeed ample external risks that shape cash flows and fundamental creditworthiness, and for which constant vigilance and ability to peer around the corner would serve investors well, IG rating outcomes often hinge on internal leverage decisions made by management. Interestingly, the interest rate environment may play a key role in these decisions. More on this later, but first a broader look across the general ratings framework.

Given the dominant role of external rating agencies, corporate credit investors of all types should seek to understand the primary components and motivations behind ratings. A cursory look into the methodologies of the big three rating agencies (S&P, Moody’s and Fitch) would reveal common grouping of factors into three buckets: (1) the overall macro-economic environment, (2) industry-specific factors, and (3) firm-specific features, such as franchise strength, scale, profitability, risk management, capital structure, and financial policy. For corporate credit research analysts, significant time and effort is spent deepening insight across all three buckets. The economic cycle has significant impact on the earnings capacity and the health of balance sheets across corporate sectors. Thus, having a good pulse on near-term economic trends pays coupons, so to speak. Similar duty and care exist when managing secular industry shifts, whether it is the decline of the coal industry or the current disruption in the automobile sector. That said, recession risk has not been a major driver of rating changes in the recent past, excluding the Great Financial Crisis. Rating agencies purport to look through the economic cycle before initiating action, as Fitch’s rating through-the-cycle (TTC) graph below explains. Likewise, negative impact from industry decline or disruption is often slow-moving, owing to the significant market share of IG firms. In turn, this permits liquidity-focused credit investors to adeptly reduce exposure without material risk of mistiming.

Source: Fitch Ratings

The largest source of immediate volatility in IG credit ratings is often M&A activity in the form of large debt-financed acquisitions, strategic split-ups, and/or changes in management disposition toward capital allocation and financial policy. The potential for such events should be assessed on a continuous basis along various factors. There are factors idiosyncratic to the firm, such as competitive position, management disposition and incentives, and ownership structure. And there are factors that influence corporate decision-making and activity on a broader basis, such as equity market multiples or interest rate levels. In either case, actions to alter capital structure, and increase or decrease leverage, are often conscious decisions for IG issuers, as is their choice of an optimal credit rating. Barclays Research notes that “as a general matter, IG issuers have been incredibly profitable over the past several decades and could retain earnings and/or manage their issuance sufficiently to achieve their target capital structure, whatever it happened to be.”

Understanding the Trend

In the same research, the authors examined the long-term trend in IG ratings from 1990 to 2020, seeking to explain the substantial increase in concentration toward BBB-rated issuers over that time. After discounting other theories, including the greater usage of the corporate debt tax shield to lower spread differentials between single A and BBB ratings, the authors presented the case that the principal driving force for the multi-decade migration of industrial issuers toward BBB ratings had been the secular decline in interest rates. In other words, as the cost of debt declined (not only on an absolute basis, but more importantly, relative to the cost of equity), management sought to optimize their capital structure, and increased their leverage by issuing relatively cheaper debt to repurchase their more expensive equity. All this was done, largely, for the sake of maximizing earnings per share. All else equal, higher leverage translated to lower ratings by the agencies. The authors deduced that the “sweet spot” credit rating – i.e., the rating most aligned with management’s perceived optimal capital structure – for most investment grade issuers prior to 2000 was ‘A’ or higher, but by 2020, that sweet spot had shifted to BBB.

Source: Bloomberg, BofA, Oleg’s Chartbook.

Anticipating the future

What does this imply about the long-term trend from now to the foreseeable future? Much has occurred in the financial markets since 2020, not least of which has been a sharp rise in interest rates, which has raised the cost of debt financing for corporations large and small. On the other hand, equity markets have also risen, which has reduced the cost of equity for publicly traded companies. As a result of the shift in relative cost between the two forms of financing, the so-called “sweet spot” rating for companies has likely shifted upwards. Assuming a higher-for-longer rate environment, companies would likely seek to optimize their capital structure by lowering their leverage gradually via lower net debt issuance relative to their earnings.

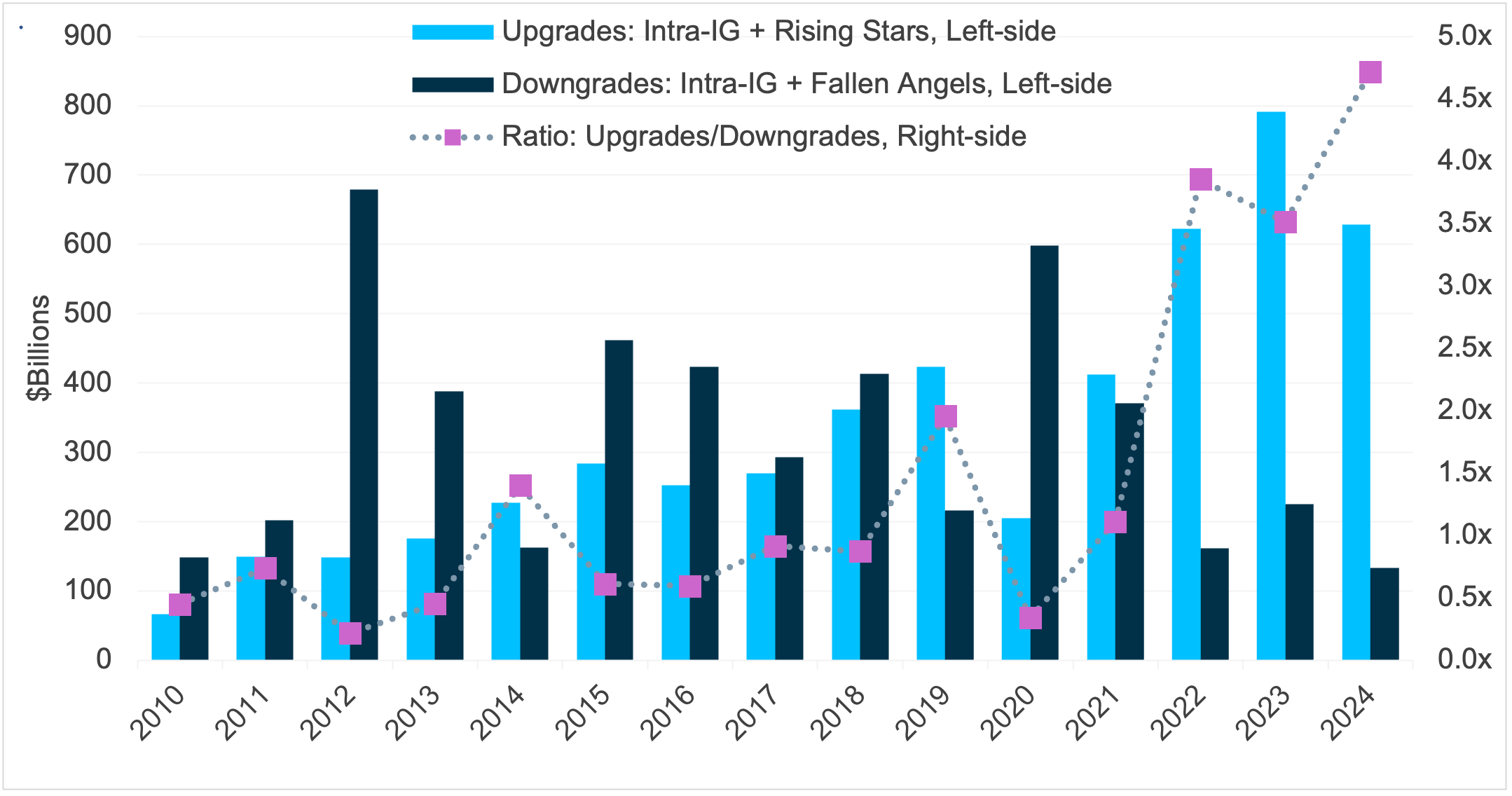

Recent evidence seems to indicate that a reversal has already begun, with IG rating upgrades outpacing downgrades in 2024 by a ratio of 4.7x (in terms of dollars outstanding), according to JPMorgan Research. Furthermore, upgrades have exceeded downgrades at an increasing pace since 2021. While one might reason that conservative financial policy has been driven not only by higher debt financing costs, but also by recession concerns, the recent trend suggests a corroboration of at least some of the long-term thesis.

Source: JPM Research

Finally, the specter of prolonged restrictive debt financing may be cause of concern for some IG investors, particularly as economic and corporate growth rates appear to be slowing. It may be worth mentioning again that the bulk of IG corporates hold large, stable balance sheets and strong profitability profiles, which provide significant flexibility to manage leverage throughout the economic cycle. This suggests that rating outcomes can largely be orchestrated accordingly by strong management teams. Still, the potential for cyclical beta-driven ratings risk remains.

In our view, however, the trade-off between capturing incremental yield and taking on marginally higher credit risk can be quite attractive in select BBB credits, even for risk-averse investors or portfolios with higher liquidity needs. The credit research team here at SVB Asset Management has proven adept at minimizing negative ratings risk for our clients’ portfolios, whether driven by macro volatility, industry fundamental deterioration, or management whim. And given that the current long-term ratings upgrade/downgrade trend is favorable, the BBB IG niche continues to earn high grades.

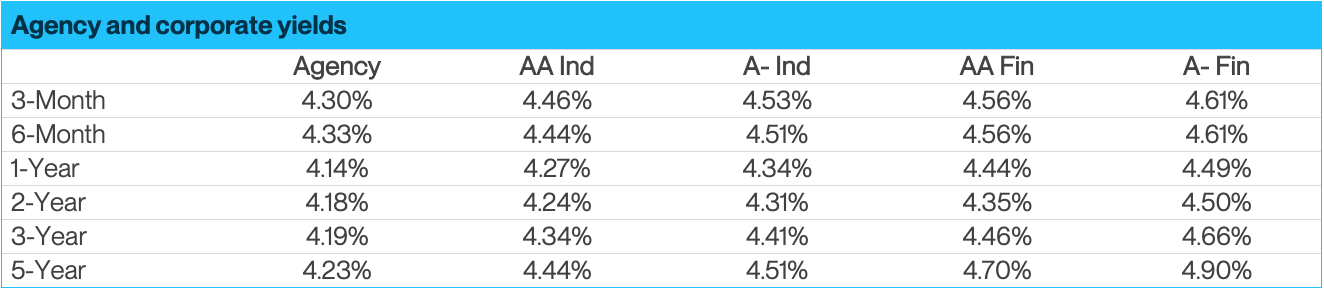

Sources: Bloomberg and SVB Asset Management as of 02/28/2025.

Sources: Bloomberg, Tradeweb and SVB Asset Management as of 02/25/2025.

Source: Bloomberg, Tradeweb and SVB Asset Management as of 02/25/2025.

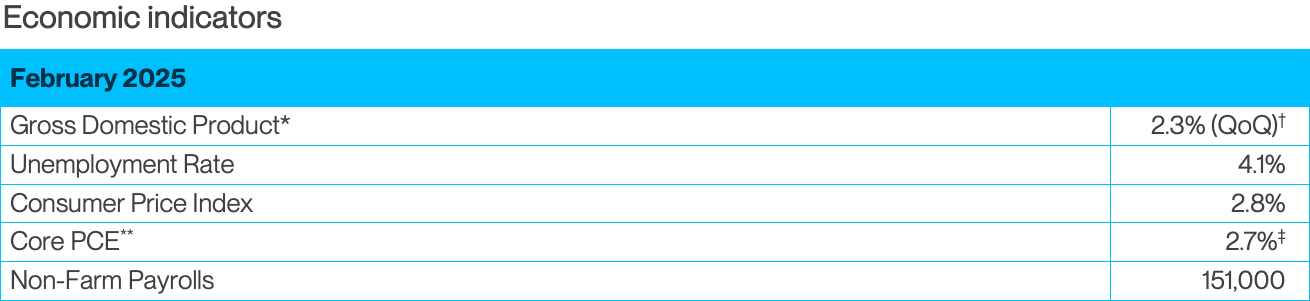

Source: Bloomberg and Silicon Valley Bank as of 02/28/2025. US Bureau of Economic Analysis (BEA) and US Bureau of Labor Statistics. *Current GDP release as of 02/27/2025. †QoQ — Quarter-over-Quarter. **Core Personal Consumption Expenditures. ‡Current PCE release as of 02/28/2025.