- The BBB market offers potentially attractive investment opportunities for investors who want to add incremental income for slightly higher—but largely manageable—risk.

- The decision to include a lower-rated security in a portfolio comes with many different considerations, including risk tolerance, return expectations, and security and sector preferences.

- When investing in securities with lower credit ratings, fundamental credit analysis and portfolio positioning must play an even greater role to manage the added risk and potential volatility and liquidity concerns.

Credit vista: Do BBBs make the grade?

Michael Duranceau, Credit Analyst

Investors are always eager to grab some incremental yield, but the trick is doing it in a smart and risk-managed approach. In our view, select BBB (“Triple-B”) corporate bonds earn high grades for their potential in today’s environment. The slightly lower credit quality of BBB corporate bonds is one way investors can enhance total portfolio income thanks to the attractive credit spreads offered by these securities over higher-rated bonds or Treasuries.

Investing in BBB securities involves taking on some additional credit risk in return for these higher spreads, but it also offers diversification benefits given the large BBB-rated debt market, which has grown substantially over recent years. Though some investors who prioritize capital preservation and liquidity traditionally have shied away from this section of the corporate bond market, we argue that there’s an important place for these bonds in many portfolios given their historical safety and increased rates of return when compared to higher-rated bonds or Treasuries.

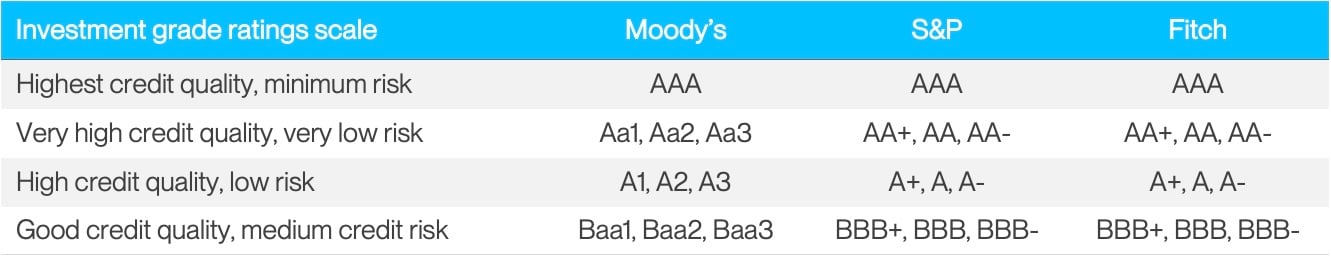

Before we dig into this section of the debt market, let’s take a step back and define what BBB-rated bonds are. To note, we will be using the terms BBB/Baa interchangeably throughout this article in reference to this rating category of investment grade bonds, as well as "high yield" or “speculative grade” when referring to non-investment grade bonds. At a high level, bonds and bond issuers can be categorized into various letter-grade rating buckets, from AAA (Prime) all the way down to C or D (near or in default). Bonds with a rating of BBB- (on the S&P and Fitch scale) or Baa3 (on Moody's scale) and better are considered "investment grade”. Bonds with ratings below BBB-/Baa3 are considered "non-investment grade.” Investment grade bonds are considered generally safe investments with relatively minimal default risk, but naturally also provide lower yields. Non-investment grade bonds are riskier, though they also offer potentially higher yields to compensate investors for the additional risk being assumed. The non-investment grade market is not generally aligned with our client’s goals, and as such, we maintain our focus on the higher-quality, or investment grade, bond sector.

To be clear, BBB bonds still maintain investment grade creditworthiness and are categorized by the rating agencies as such, though at a lower investment grade designation. S&P and Fitch generally define BBB obligations as “good credit quality,” including “expectations of default risk are currently low and the capacity for payment of financial commitments is considered adequate, but adverse business or economic conditions are more likely to impair this capacity.”[1] Moody’s defines obligations that are rated BBB to be “medium-grade and subject to moderate credit risk and as such may possess certain speculative characteristics.”[2] We generally view BBB rated obligations as debt that carries marginally higher credit risk due to micro (business-specific risks) and/or macro (economic environment-specific risks). Nevertheless, these lower-rated investment grade securities remain relatively safe investments with historically low rates of default and losses.

An attractive trade-off?

The SAM team continues to see significant opportunities for investors to extend investment duration while also remaining discerning in security selection in order to lock in higher yields, even as the Federal Reserve continues its rate cutting cycle. While the period of earning over a 5% yield on ultra-low risk US Treasuries is effectively over, there are several options to maintain attractive investment returns, all while remaining risk-averse and sensitive to liquidity needs. Extending duration by purchasing longer-dated bonds or investing in other asset classes are ways to capture higher yields as interest rates fall. Another option is to invest in lower-rated investment grade bonds (i.e. BBB-rated bonds). BBB-rated bonds tend to offer more attractive yields stemming from higher credit spreads due to the increased credit risk profile when compared to higher-rated bonds. Still, we believe this risk can be well-managed through fundamental research and keen security selection.

Let’s take a brief look at current credit spreads and what they mean for bond investors. For a more in-depth dive into credit spreads and yields, be sure to read our recent Market Insights article from November 2024 titled, “Look at That Spread!”.

Credit spreads represent the additional yield that bond investors receive above and beyond benchmark fixed income yields, such as those on US Treasury securities. While treasuries are considered essentially risk-free investments, corporate bonds carry various risks, including default and downgrade risk. As compensation for this risk, investors in a corporate bond demand a yield greater than the yield on a similar maturity Treasury. This extra yield is known as the credit spread. Though credit spreads have narrowed considerably due in part to strong corporate fundamentals and a resilient US economy in recent years, all-in corporate bond yields remain attractive and sit at multiyear highs. At the time of this writing, the 1-3 Year US IG Corporate Index offered a 4.68% yield, and the 1-3 Year US BBB Corporate Bond Index offered a 4.82% yield, both well above current Treasury yields.3

The two charts below illustrate the historical incremental credit spread and yield over higher-rated bonds. While it may seem obvious, it bears repeating that despite various market dynamics, lower-rated bonds have consistently offered excess returns over their higher-rated counterparts.

While credit spreads remain tight due to both macro and micro-related factors, the ability to gain additional yield by investing in slightly lower-rated bonds can be beneficial for investors who are looking to maximize returns while maintaining a low risk profile. As always, investors want to know how much additional risk must be taken to capture incremental yields, and is it a fair trade-off? After all, increased returns mean nothing if you’re putting investment principal at significant risk.

What does history teach us?

When stretching for incremental yield, default risk is one of the primary concerns for bond investors given the potential loss on investment and unexpected disturbance of interest payments. Default risk is essentially the risk that the bond issuer will be unable to pay interest or principal payments prior to the bond’s maturity.

To assist in determining credit risk of BBB-rated bonds (essentially the risk of default), we evaluate several metrics, including historical default rates, average loss rates, and rating migration data. The three major rating agencies (Moody’s, S&P, and Fitch) publish annual bond default studies that can be particularly helpful in determining whether the additional risk assumed in lower-investment grade bonds is consistent with capital preservation and liquidity objectives. For simplicity purposes we will only be analyzing Moody’s bond default data in this article.

In its most recent annual default study published in February 2024, Moody’s cited elevated interest rates, tighter financing conditions, and lingering inflation as factors driving up overall corporate defaults in 2023. However, while 159 corporate issuers rated by Moody’s defaulted in 2023 (compared to 157 in 2022), only four of those defaults were investment grade issuers (compared to 17 investment grade defaults in 2022). The overall corporate default rate in 2023 was 2.28% (inclusive of both investment grade and non-investment grade issuers). Furthermore, Moody’s expects the overall corporate default rate to moderate over the near-term closer to its long-term average of 1.8% since 2000.

According to Moody’s, the average annual default rate specifically for Baa issuers under its coverage has been 0.19% since 1981, compared to the 0.04% and 0.03% average default rate for A and Aa-rated issuers, respectively. To note, Aaa issuers have maintained a 0.0% default rate during this period. While the modestly higher average Baa default rate is not necessarily surprising given these issuers tend to have slightly weaker financial profiles, the Baa default rate remains at historically low levels. In comparison, the average default rate for non-investment grade issuers over the same period was 4.22%.1 All this gives us a degree of confidence in the market for slightly lower-rated securities.

Looking at credit loss

Credit loss rates are another data point investors can look at when determining credit risk. Moody’s publishes annual average credit loss rates, which are a function of both the probability of default and loss given default (LGD). This essentially provides the average amount a bondholder can anticipate losing if the issuer defaults. Since 1983, BBB/Baa issuers covered by Moody’s have historically averaged 0.12% in annual loss rates, compared to ~0.02% for both A and Aa-rated issuers. In comparison, the average annual credit loss rate for non-investment grade issuers during this period was higher at 2.45%. The average annual credit loss rate for all Moody's-rated corporate issuers (investment grade and non-investment grade) was 1.5% in 2023, while averaging just 1.0% since 1983.

While both the average annual default rate and average annual credit losses for BBB/Baa issuers are higher than A- and above issuers, they remain modest historically and are considerably lower than the rates of non-investment grade or high-yield issuers.

Rating migration

Rating downgrades can also be of concern to investors that are considering BBB names, as a negative rating change from low-investment grade to non-investment grade can have an impact on portfolios given minimum bond rating constraints. Using Moody’s ratings data since 1920, we can see that the average risk of a BBB/Baa name being downgraded to non-investment grade over the course of a year has been approximately 4.76% (4.02% chance of move to Ba, 0.63% to B, 0.11% to Caa). While not immaterial, it illustrates the relatively low risk of BBB names being downgraded out of the investment grade category altogether. Conversely, the chance of a BB/Ba name being upgraded to BBB/Baa is higher at 6.48%.

Source: Moody’s Annual Default Story; data as of 2/26/2024.

A robust BBB market

BBB supply has grown significantly over recent years, largely due to a surge in M&A activity and companies that are increasingly open to lower investment grade ratings. Companies with historically non-investment grade ratings are also being upgraded to investment grade (also known as “rising stars”) at a faster rate compared to historical standards. According to Barclays Research, since 2021 there have been net $239 billion in rising stars, the largest net volume over any four-year period since at least 1997.[1] Barclay’s noted that corporate bond issuers have generally remained fundamentally sound in the years following COVID, managing cash balances conservatively and putting the effort in to acquire or maintain a minimum of low-investment grade ratings.

Overall investment grade corporate bond issuance has been very strong during 2024. Investment grade new issuance has already exceeded full year levels for each of the past three years, including the second highest ever annual amount achieved in 2021. BBB-rated bonds made up 39% of total year-to-date new issuance as of month-end November 2024, slightly above the 37% BBB average since 2004.

Strong BBB new issuance and supply is also reflective in the categories’ weighting across the investment grade bond market, with BBB rated issuers currently making up ~40% of the ICE BofA 1-3 year index, compared to 35% in 2014 and 26% in 2004.

Source: Bloomberg, ICE BofA US Corp 1-3 Year Index (C1A0). Bloomberg Composite Rating is a blend of a security’s Moody’s, S&P, Fitch, and DBRS ratings. Data as of December 2024.

The final grades

In our view, the data points to the BBB market as an attractive investment opportunity that balances an incremental increase in risk in exchange for higher returns. As always, the decision to include a particular security type in a portfolio comes with many different considerations, including risk tolerance, return expectations, and security and sector preferences. Additionally, fundamental credit analysis and portfolio positioning must play an even greater role when investing in lower-rated credits given the increased risk profile and potential volatility and liquidity concerns. As such, our dedicated investment research, portfolio management, and trading teams continually work to help address these challenges as we navigate the ever-changing investment landscape.

Trading vista: Turning the page

Jason Graveley, Senior Manager, Fixed Income Trading

Just as we are ready to turn the page on the calendar year, the economy is doing the same and shifting into a new phase. Although we avoided recession and the Fed helped orchestrate a soft landing in 2024, it does appear that we are entering into a low-hire, low-fire part of the economic cycle. As such, investors are reflecting on the past year and pondering how to best position for the year ahead.

Bond markets saw significant volatility throughout 2024 as investors debated and finally coalesced around a consensus path for monetary policy. Based on the shape of the yield curve today—which is more conventional compared to the inversion that was in place for quite some time—investors aren’t currently anticipating many surprises. Indeed, much of 2024 was spent discussing the yield curve inversion and handicapping when and how aggressively the Fed would begin cutting rates. But as the year wound down, markets have had a respite to some degree, and volatility has dampened as yields have settled into more of a range. For example, if we look at the 2-year Treasury, its yield peaked at 5.03% in April and dipped to its lowest close of 3.54% in September. In other words, yields dropped more than 150 basis points (bps)over those six months. Now consider that the 2-year Treasury yield began 2024 at 4.25% and currently trades around 4.12%, at the time of this writing. That’s quite the ride given that yields are within 15 bps of where they started the year. So, with all that in mind, how are investors thinking about the market and what should they expect in 2025?

After spending much of 2024 inverted, the Treasury curve has flattened across tenors. The 12-month Treasury bill is trading within 1 bps of the 10-year Treasury yield at the time of this writing. As growth is expected to slow and inflation continues to move toward the Fed’s 2% target, the expectation is that the Fed can remain cautious in its approach to cutting rates. The market’s implied probability for rates suggests a few quarterly rate cuts in 2025, with March and June showing as the most likely dates. If we compare this to how the rate cut cycle kicked off with a more aggressive 50-bps reduction at the September FOMC, you can see the cautious optimism incorporated into the Fed’s thinking.

Where investors go from here will depend on their income needs and risk tolerance, but generally there is an expectation to adopt a more neutral stance for duration. With a slower and shallower easing cycle than originally anticipated, segmented liquidity investors may be inclined to remain in money market funds longer, with less impetus to lock-in yields across a flatter yield environment. Money market supply is also projected to increase only marginally, and many of the technical factors that have weighed on spreads are expected to remain in place into the start of 2025. The economic policies of our new political leadership also could be a catalyst for higher rates and wider spreads, as concerns have risen around some of the proposals—namely tariffs and tax cuts—that could prove to be inflationary. At present, however, it is too early to know the scope or likelihood of either. So, while we expect to start 2025 in many ways similar to how 2024 ended, it won’t take much to shift the outlook. We continue to closely monitor the landscape and will be ready to take advantage of the dynamic environment as we pass into the new year.

Source: Bloomberg and Silicon Valley Bank as of 12/02/2024.