- The U.S. economy proved resilient in 2024, and financial markets performed admirably despite periods of volatility. Stocks moved markedly higher while the yield curve un-inverted.

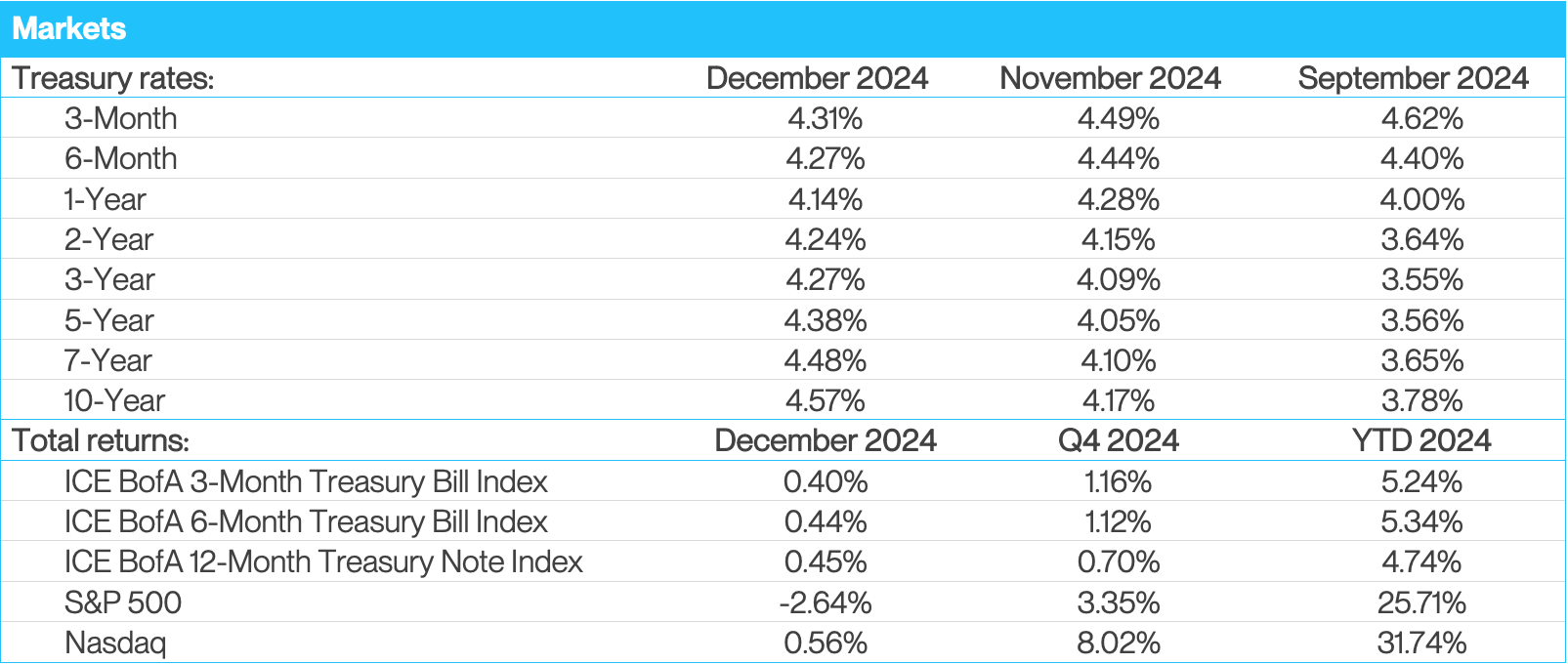

- The Federal Reserve began a new rate cut cycle—admittedly later in the year than many investors originally expected. The Fed cut interest rates by a total of 100 basis points during 2024, but the extent of future rate cuts is uncertain as inflation remains above the 2% target.

- We remain cautiously optimistic regarding the outlook for the economy and financial markets in 2025, though we acknowledge that ample risks remain, and vigilance is required.

Economic vista: Cautiously optimistic

Jose Sevilla, Senior Portfolio Manager

There’s no denying that 2024 was an unforgettable year in terms of pop culture. Taylor Swift's Eras tour grossed over $2 billion, and the film "Oppenheimer" swept the Oscars with seven awards, including Best Picture. The Paris Olympics captivated global audiences, showcasing the talents of gymnast Simone Biles, swimmer Katie Ledecky, and Steph Curry's heroic performance in the gold medal game against France.

When it comes to the more mundane economic and political front, the year was equally intriguing. Geopolitics dominated global headlines as conflicts in Russia/Ukraine and the Middle East continued to rage. Domestically, politics took center stage as Donald Trump won the U.S. Presidential election while the Republican Party won control of both Houses of Congress. And in terms of monetary policy, the Federal Reserve (Fed) finally began a long-anticipated rate-cut cycle.

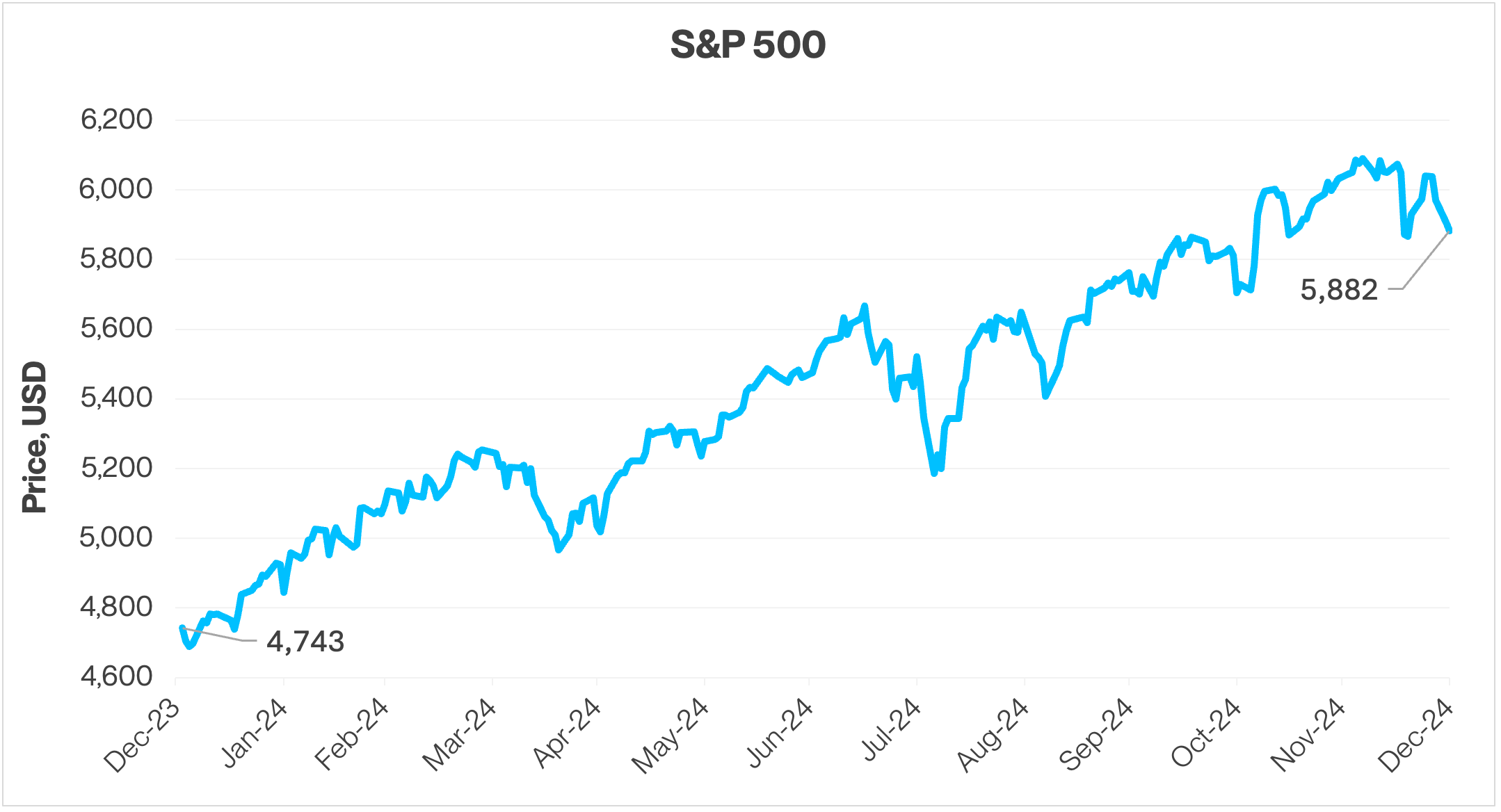

As the news ebbed and flowed, all these factors contributed to periodic bouts of market volatility over the course of the past year. But in the end, all major U.S. stock indices soared, with the S&P 500 ending the year up more than 23%. This surge was driven by robust corporate earnings and a resilient economy, along with GDP growth of approximately 2.1% for the year. Also helping to drive stocks higher was the Fed’s interest rate cuts, which began in September and created a favorable environment for equities.

Source: Bloomberg. Data as of 12/31/2024.

Source: Bloomberg. Data as of 12/31/2024.

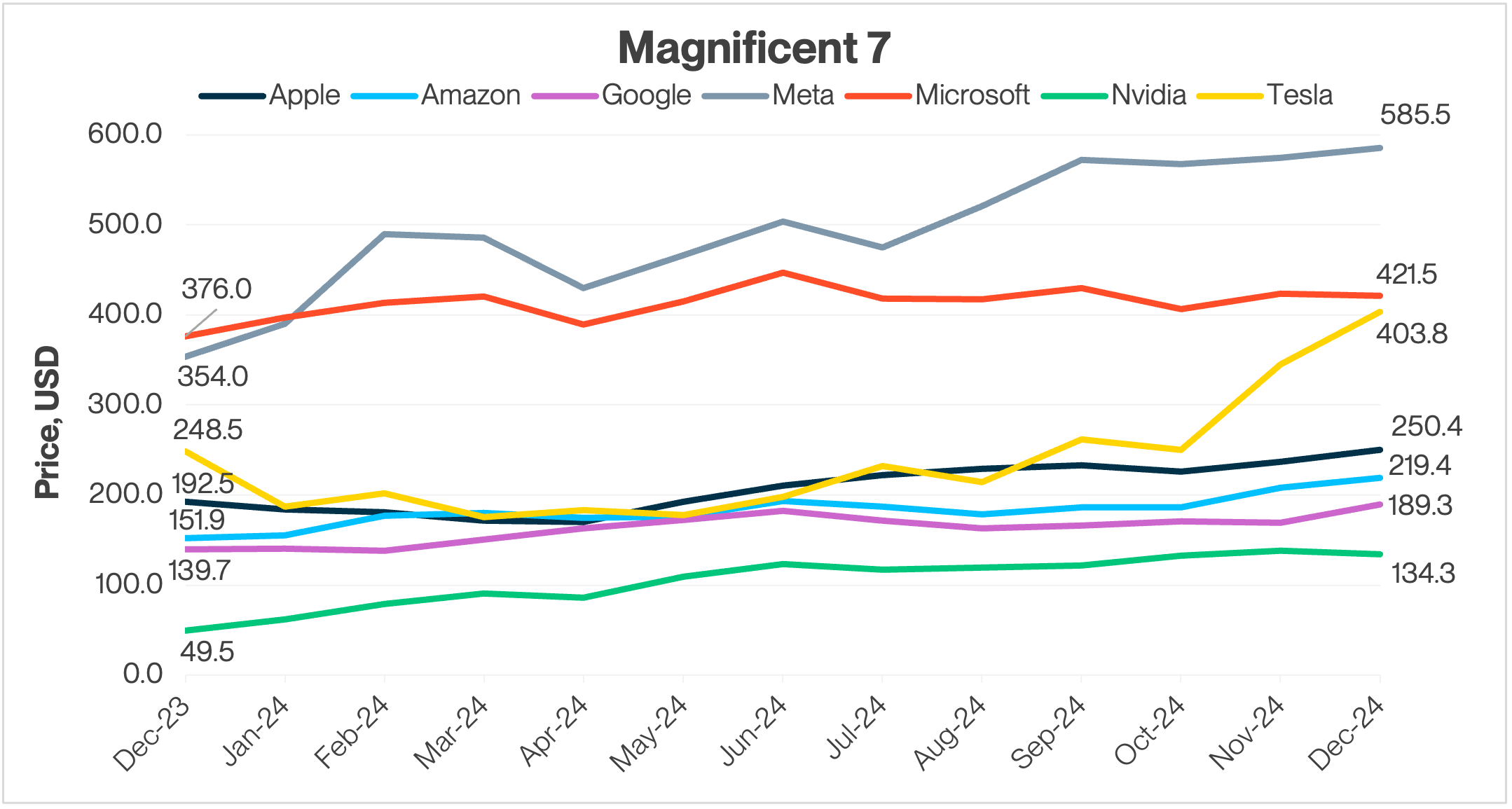

The "Magnificent 7" mega-cap tech stocks (Apple, Amazon, Google, Meta, Microsoft, Nvidia, Tesla) continued to outperform, significantly contributing to overall market gains. These tech stocks soared on the artificial intelligence (AI) boom, with companies like Microsoft, Google, and Meta investing billions in various AI initiatives. Nvidia, which sells the chips to these big companies, continued its remarkable growth, and became one of the most valuable companies in the world.

Source: Bloomberg. Data as of 12/31/2024.

Source: Bloomberg. Data as of 12/31/2024.

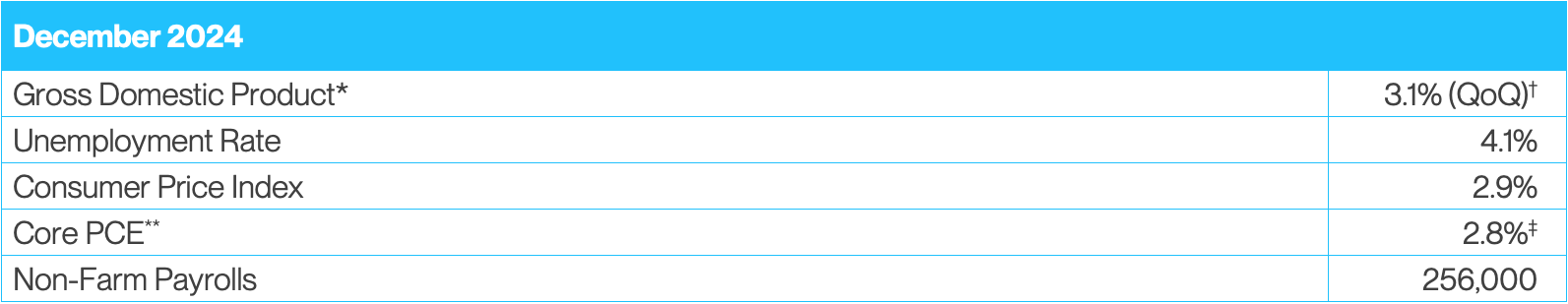

The economy hangs tough

Although there was some concern earlier in 2024 that the U.S. economy was headed for recession, the year ended on a positive note. The Fed seems to have orchestrated a soft landing for the economy and has skillfully navigated its dual mandate of stable inflation and low unemployment. In 2024, inflation followed a downward trend that began early in the year but remained above the Fed's 2% target. The job market also showed signs of slowing as companies adjusted to higher labor costs and global economic uncertainties. Nevertheless, the unemployment rate remained relatively low throughout the year. Wage growth was modest, consumer spending proved resilient, and overall U.S. economic growth remained solid even if GDP growth rates fell short of expectations.

Source: Bloomberg. Data as of 11/30/2024.

Source: Bloomberg. Data as of 11/30/2024.

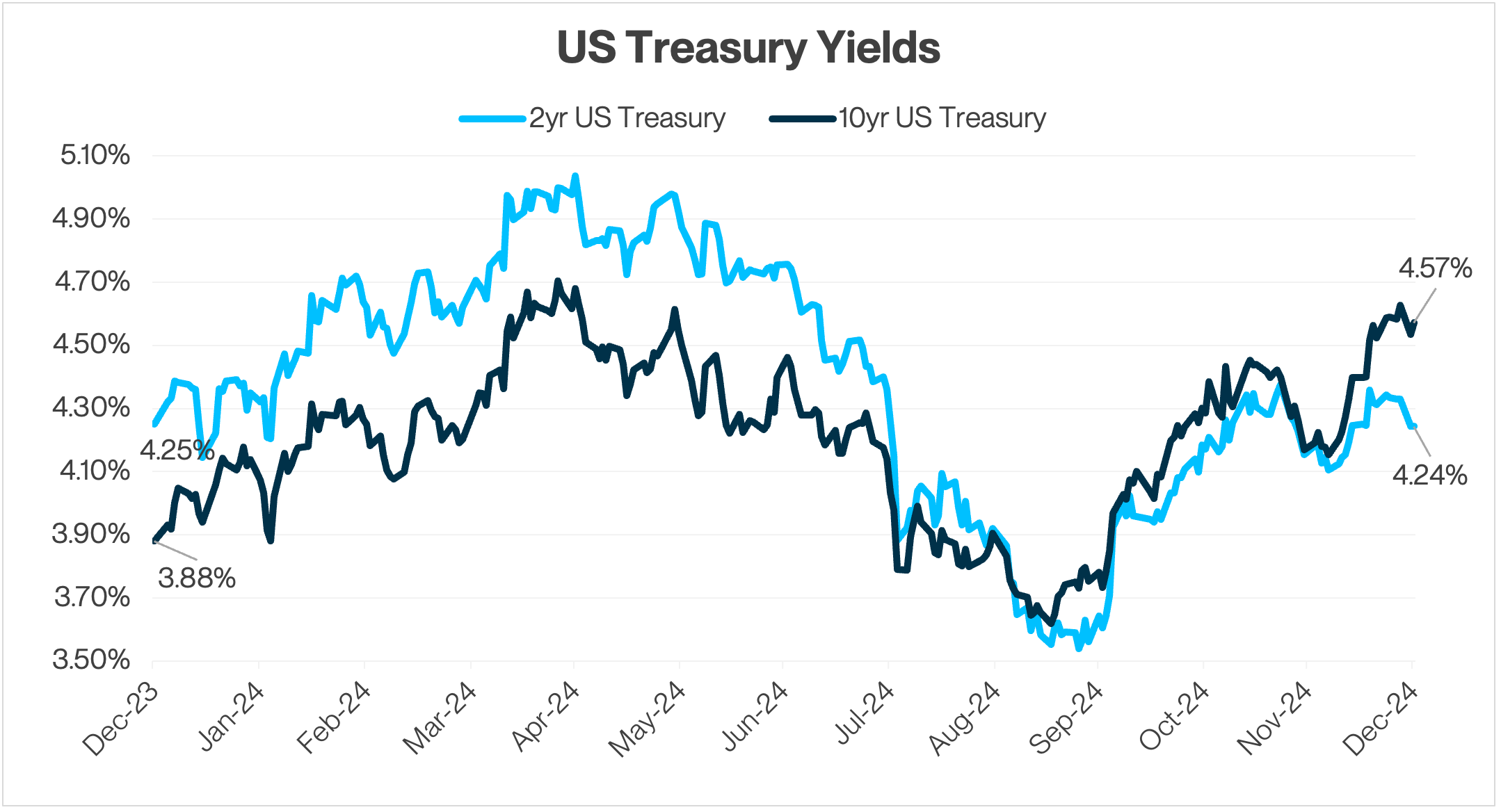

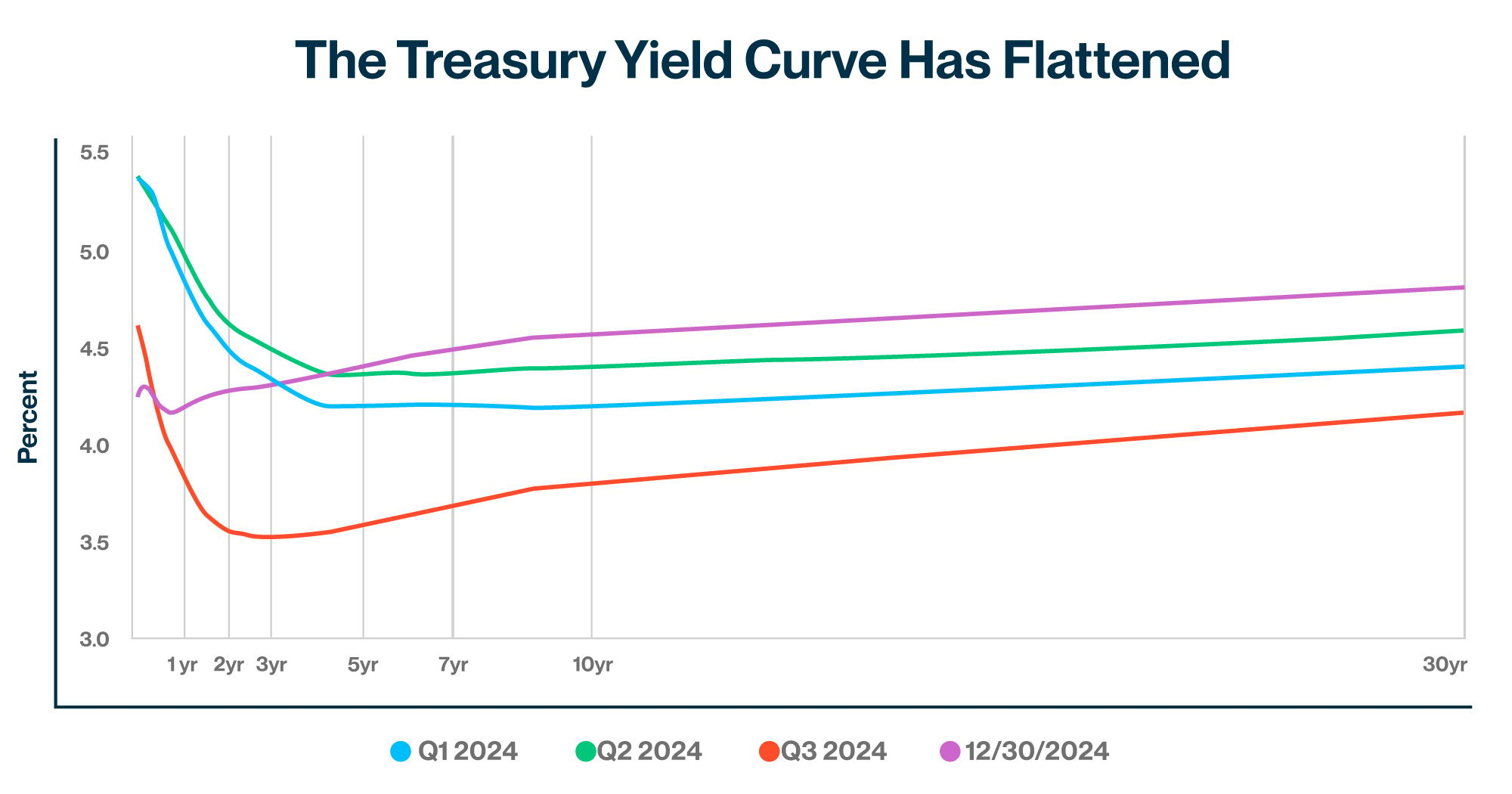

Monetary policy twists and turns

Expectations for monetary policy turned out to be a bit too optimistic at the beginning of 2024. Early in the year, futures traders had anticipated aggressive interest rate cuts to begin as early as March, with the yield curve pricing in up to eight total cuts for the year. However, such monetary easing never materialized to the extent predicted. Market participants misjudged both the resiliency of the U.S. economy and direction for interest rates, at times overshooting market calls in both directions. Initially, bond yields fell on expectations of Fed policy easing, but gains reversed as the economy showed strength and yields reverted higher from the lows of the year.

Source: Bloomberg. Data as of 12/31/2024.

Source: Bloomberg. Data as of 12/31/2024.

At the conclusion of the December FOMC meeting, the Federal Reserve cut the fed funds rate for a third straight time following cuts in September and November. However, Fed Chairman Jerome Powell lowered expectations for future rate cuts based on the positive outlook for the U.S. economy. Still, markets ended the year pricing in two more 25-basis point cuts in 2025.

Looking ahead

As we look ahead to 2025, the Federal Reserve's current policy stance remains supportive for the markets. We see the U.S. economy continuing to build on the momentum from the previous year. This positive outlook is further bolstered by expectations of lower interest rates and the anticipated arrival of the pro-business policies of a new Presidential administration. However, as 2024 clearly demonstrated, risks remain, and market participants will need to navigate several uncertainties. For example, the administration’s pro-growth initiatives might be offset by the introduction of tariffs should they prove to be inflationary. Heightened geopolitical tensions remain a significant concern as they can disrupt global trade and economic stability. Additionally, the lingering effects of inflation continue to pose challenges, potentially affecting consumer spending and corporate profitability.

Of course, we will be closely monitoring corporate balance sheets and earnings reports to gauge the financial well-being of companies. The technology sector, and in particular companies involved in AI, is likely to remain a focal point for investors due to its potential for continued innovation and growth. So, while there are some challenges ahead, we remain cautiously optimistic when it comes to financial markets in 2025. As always, we intend to monitor the risks and act opportunistically whenever possible.

Trading vista: The party rages on

Jason Graveley, Senior Manager, Fixed Income Trading

So much for a holiday hangover. The New Year got off to a banging start as new issuance markets appear primed to continue the party.

Remember, 2024 ended with roughly $1.5 trillion in investment-grade issuance, which just happened to be the second-highest level on record after the debt-fueled explosion of 2020. But despite the significant new supply and intermittent bouts of volatility, primary spreads held for most of the year and are at some of their tightest levels since the late 1990s. Naturally, concession levels were tight last year, with the difference between primary issuance and secondary trading only averaging approximately four basis points.

To further illustrate the impressive market dynamics, consider that oversubscription levels were roughly 3.7 times greater than supply in the past year. With that in mind, investors shouldn’t be surprised why the new issuance party has rolled into 2025. Technicals are working in the issuer’s favor, and investors seeking attractive absolute yields have been coping with robust demand and tight spreads. Furthermore, there has been little benchmark volatility to start the year, with 2- and 5-year Treasury notes within a few basis points of their year-end closes. It’s been an optimal setup to start the new year.

How good has the environment been? On the first full Monday of 2025, more than 22 issuers priced close to $37 billion of bonds. As is often the case, the slate was headed by domestic banks and financial services companies. This was the largest day of issuance since September 2024, when a record 29 companies came to market and priced over $43 billion. All told, activity for the first week of January blew through estimates by the end of Tuesday, which brought the weekly total to nearly $55 billion versus estimates of $50 billion. The consensus estimates for total primary issuance in 2025 is now expected to be slightly above 2024, which would make 2025 the new second-highest year on record.

Of course, these are only estimates and predictions vary widely across the bank syndicate desks, with some banks calling for close to $2 trillion in total investment-grade issuance. That figure would easily top the $1.75 trillion that was priced in 2020.

One key reason for such optimism is simply a byproduct of the record-setting year in 2020. We are now five years removed and there is nearly $1 trillion expected to mature this year as a result. That’s a lot of corporate debt being retired or rolled over. But remember, these new issuance projections are only estimates and can shift quickly if markets flip. Investors don’t like uncertainty, and there are ample reasons we may see periods of heightened volatility. Geopolitical hotspots abound, an incoming administration is implementing policies that might prove inflationary, and nobody can predict central bank moves with real certainty. So, while the issuance party is off to an optimal start, it’s the follow-through that will set the stage for an encore. We’ll be watching and positioning no matter what happens.

Sources: Bloomberg and SVB Asset Management as of 12/31/2024.

Sources: Bloomberg and SVB Asset Management as of 12/31/2024.

Sources: Bloomberg, Tradeweb and SVB Asset Management as of 12/31/2024.

Sources: Bloomberg, Tradeweb and SVB Asset Management as of 12/31/2024.

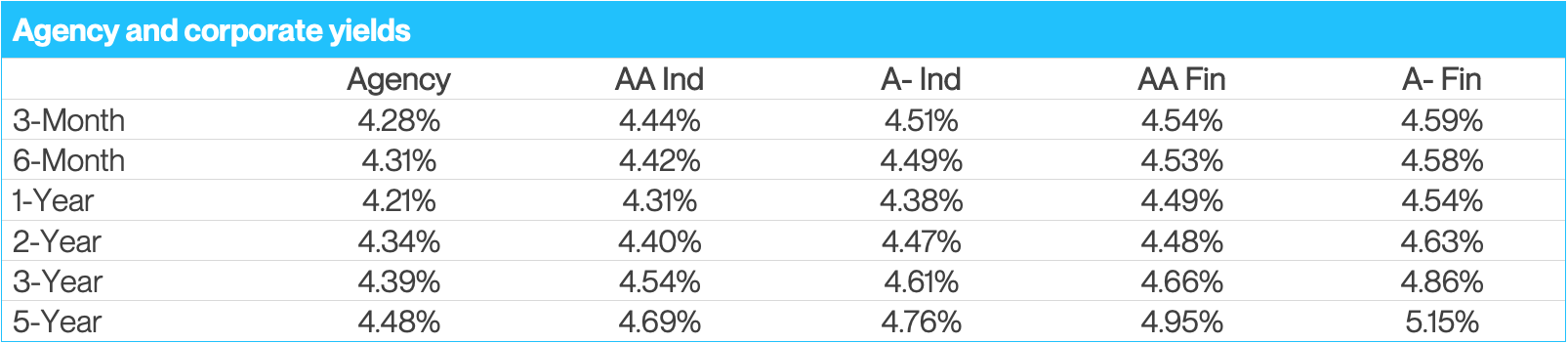

Source: Bloomberg, Tradeweb and SVB Asset Management as of 12/30/2024.

Source: Bloomberg, Tradeweb and SVB Asset Management as of 12/30/2024.

Economic Indicators

Source: Bloomberg and Silicon Valley Bank as of 12/31/2024. U.S. Bureau of Economic Analysis (BEA) and U.S. Bureau of Labor Statistics. *Current GDP release as of 12/19/2024. †QoQ — Quarter-over-Quarter. **Core Personal Consumption Expenditures. ‡Current PCE release as of 12/20/2024.

Source: Bloomberg and Silicon Valley Bank as of 12/31/2024. U.S. Bureau of Economic Analysis (BEA) and U.S. Bureau of Labor Statistics. *Current GDP release as of 12/19/2024. †QoQ — Quarter-over-Quarter. **Core Personal Consumption Expenditures. ‡Current PCE release as of 12/20/2024.