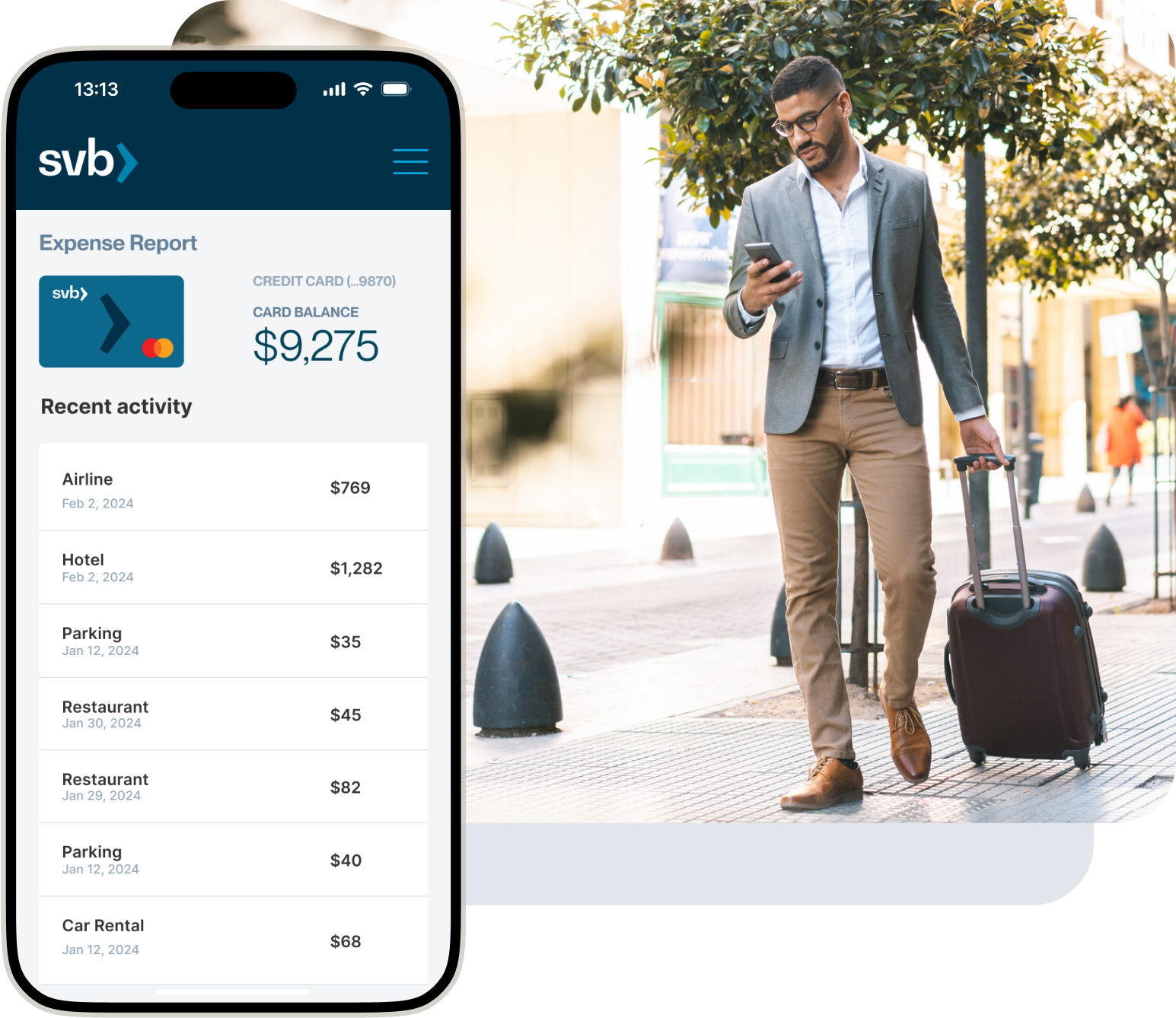

SVB Innovator Card

A scalable business card that gives you more flexibility to manage purchases and payables.

Help drive growth with higher credit limits with no personal liability1 and robust spend controls.

Special offer - You could earn 3x on all purchases and receive up to 3,000,000 rewards points2 when you open an SVB Innovator Card. Good on all purchases2 for the first six months or up to $1 million spend.

“We’re trying to take advantage of using our SVB card to earn rewards. Our small revenue stream is the cash back, it’s about $7 or $8K a month. It’s pretty important and definitely an incentive for us to make the extra effort to call our larger vendors to pay via credit card.”

— Adrianne Gonzalez, Senior Accountant, Wildtype

Reward your business with cash back to your card account, gift cards and for top brands and travel

Spend with an eco-friendly card

Ready to talk with our team?

FAQs

Yes! The SVB Innovator Card is designed to help startup founders meet evolving needs while they grow the business.

Generally, yes. SVB specializes in business credit cards for companies in tech, life sciences and healthcare, and we work with clients who operate under different legal structures.

We consider a range of factors in our credit decisions.

No two startups have the same growth trajectory. Our goal is to support you on your unique startup journey.

SVB business credit cards for startups give you a free, simple way to access scalable credit, robust spend management and business banking, all in one place – and all built to help your company succeed.

With the SVB Innovator Card your balance must be paid off in full each month. Contact your Relationship Advisor for more information about SVB’s Innovator Revolver Card that allows a balance to carry over each month and accrue interest.

1 For complete details about the SVB Innovator Card, including applicable fees and terms and conditions of the Card, see the SVB Innovator Card Terms & Conditions and Rewards Agreement. Certain terms, conditions, exclusions, and limitations apply, including a limit on cash advance capabilities.

All credit products and loans are subject to underwriting, credit, and collateral approval. All information contained herein is for informational and reference purposes only and no guarantee is expressed or implied. Rates, terms, programs and underwriting policies subject to change without notice. This is not a commitment to lend. Certain terms, conditions, exclusions, and limitations apply, including a limit on cash advance capabilities. Additional fees include: Cash Advance — 3% of each Cash Advance amount, but not less than $3 or more than $50; Late Payment — $32 or 2.5% of the charges that have been billed on the periodic statement and remain unpaid for one or more billing cycles, whichever is greater.

2 This offer is only available for new Innovator Card charge programs setup on rewards with company bill and company rewards. Offer expires 7/31/2025.

3,000,000 rewards points are based on:

• Net purchases made on the SVB Innovator Card. Rewards points are not applicable to virtual cards.

• Receive one additional bonus point on net purchases (minus returns/credits) until the bonus period expires: (1) when you reach the $1 million spend threshold, or (2) six months from the date of your enrollment in this promotional offer, whichever comes first.

• The enrollment process for this program can take up to 10 business days. You will not earn any additional bonus points until the enrollment process has been completed.

• Rewards points will be awarded 30 days after the eligible dollar amount has been spent collectively between the cards within your program.

Once the bonus period expires, you will earn 2X Unlimited Rewards.

3 2X Unlimited Rewards Points earnings are based on net purchases (minus returns/credits) made on the SVB Innovator Card. SVB virtual cards can earn 1x rewards on all purchases, or revenue share at the rate determined by the client relationship. Points can be redeemed for a variety of rewards, including travel and cash back. Cash back: Cash Rewards points can be redeemed as a statement credit to your card account. For complete details about the SVB Innovator Card, including applicable fees and terms and conditions of the Card, please see the SVB Innovator Card Terms & Conditions and Rewards Agreement.

Mastercard is a registered trademark of Mastercard International Incorporated and is an independent third party and not affiliated with Silicon Valley Bank, a division of First-Citizens Bank & Trust Company.

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with permission of EMVCo, LLC. EMVCo, LLC is an independent third party and not affiliated with Silicon Valley Bank, a division of First-Citizens Bank & Trust Company.

All non-SVB named companies listed throughout this document are independent third parties and are not affiliated with Silicon Valley Bank, a division of First-Citizens Bank & Trust Company.

Banking and lending products or services are offered by Silicon Valley Bank, a division of First-Citizens Bank & Trust Company. Accounts are subject to credit approval. Restrictions and limitations may apply.